- 1.14 MB

- 37页

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

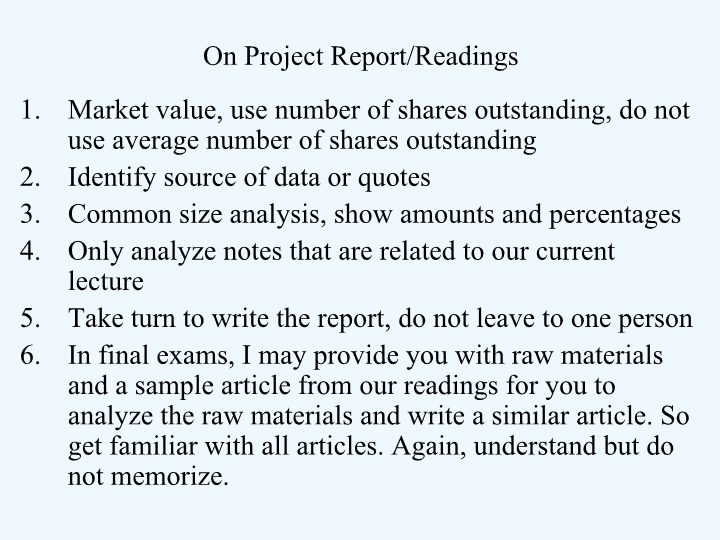

'OnProjectReport/ReadingsMarketvalue,usenumberofsharesoutstanding,donotuseaveragenumberofsharesoutstandingIdentifysourceofdataorquotesCommonsizeanalysis,showamountsandpercentagesOnlyanalyzenotesthatarerelatedtoourcurrentlectureTaketurntowritethereport,donotleavetoonepersonInfinalexams,Imayprovideyouwithrawmaterialsandasamplearticlefromourreadingsforyoutoanalyzetherawmaterialsandwriteasimilararticle.Sogetfamiliarwithallarticles.Again,understandbutdonotmemorize.

FirmNamesEagleEye:ValuationAnalysisStrategyInvestorium

StatementofCashFlowCashflowfromOperatingactivities:(营运活动)cashreceiptsfromcustomerscashdisbursedto:suppliersofmerchandiseemployeesforsalariesCashflowfrominvestingactivities:(投资活动)purchaseofbuildings,equipments,plantsproceeds(进帐)fromsalesoflongtermassetsCashflowfromfinancingactivities:(融资活动)borrowing/repaylongtermdebtsissuingnewshares

OverviewoftheStatementofCashFlowsInAOL2000balancesheet,cashandcashequivalentincreasedfrom$936millionsto$2,490millions.How?Thestatementofcashflows…(a)explainsthereasonsforachangeincash.(b)classifiesthereasonsforthechangeasanoperating,investingorfinancingactivity.(c)reconcilesnetincomewithcashflowfromoperations.

MontgomeryWardb.f.bankrupt

ThedifferencebetweenearningsandcashflowsI/SExplainchangeinretainedearningsI/Sisaccrued-basedI/SrecognizepropertyrightsI/SrequireestimatesI/SisanopinionI/Sisproneto(易于)manipulationFirmscansurvivealongstring(长串)ofnegativeearningsSCFexplainchangeincashandcashequivalentN/ASCFemphasize“actualpossessment”SCFdoesnotSCFisafactSCFissotoamuchlessdegreeFirmsgobankruptwithalongstringofnegativecashflows(outflow)

CashflowequationA=L+EΔA=ΔL+ΔEΔcash+Δnon-cashA=ΔL+ΔEΔcash+ΔcurrentA(otherthancash)+Δnon-currentA=ΔcurrentL+Δnon-currentL+ΔEΔcash=ΔcurrentL+Δnon-currentL+ΔE-ΔcurrentA(otherthancash)-Δnon-currentA

CashflowfromoperationCashflowsrelatedtosellinggoodsandservices;thatis,theprinciplebusiness(主营业务)ofthefirmThemainsourceofpayoffstoshareholdersandcreditorsThereasonforthefirmstoexistIffirmsdonotinthelongrungeneratemorecashfromoperationthanthereturnsoffundstoshareholdersandcreditors,thefirmsgobankrupt

Cashflowfromoperation-componentsCashcollectedfromcustomersCashcollectedasinterest(利息)onloanstoothersCashcollectedasdividends(股利)oninvestmentonotherfirms’stocksCashpaidtosuppliersCashpaidtoemployeesCashpaidtootherserviceproviders:landlords,marketingagency,auditors,consultants,…CashpaidtogovernmentCashpaidtocreditorsasinterestonborrowedmoney

CashflowfrominvestingactivitiesCashflowsrelatedtotheacquisitionorsaleofnon-currentassets:investment,land,property,plants,equipments…Tomaintainthecurrentproductivityoftheoperation,afirmmustreplaceassetsthattheywearout(消耗)Togrowitsoperation,afirmmustacquireadditionalassetsOldassetsmaybesoldastheybecomeobsolete(过时),orasthefirmchangeproductionInvestingactivitiesthusprovideresourcetogeneratecashflowfromoperations

Cashflowfrominvestingactivities-componentsCashreceivedfromsalesofland,investment,property,plantsandequipmentCashpaidtoacquireland,investment,property,plantsandequipment

CashflowfromfinancingactivitiesCashflowsrelatedtolong-termliabilitiesandowners’equityThesourceofcashtobeusedininvestingandoperatingactivitiesTwosources:shareholdersandcreditorsThispartofSCFalsoindicateshowmuchcashthefirmreturnstoitscapitalproviders,i.e.,cashdistributiontoshareholdersandcreditorsNote:short-termliabilitiesgeneratedinoperation,suchasaccountpayable,isnotrelatedtothiscategory

Cashflowfromfinancingactivities-componentsCashreceivedfromissuingcorporatedebtsortakinguploansCashreceivedfromissuingcommonsharesorpreferredsharesCashpaidtorepaydebtsorloansCashpaidtorepurchasesharesCashpaidtoshareholdersasdividends

Relationsamongthecashflowsfromthethreecategoriesofactivities1CFfromFin.Act.CFfromInv.ActCFFromOp.Act.

FreeCashFlow=Cashflowfromoperatingactivities+CashflowfrominvestingactivitiesIfpositive,normaloperationgeneratesmorecashthatitconsumes,suchasthecaseofastablefirmIfnegative,normaloperationgeneratesinsufficientamountofcashtobeself-sustaining,suchasagrowingfirm

TwomethodstopreparetheoperatingportionofSCFDirectmethodofpresentationcalculatescashflowfromoperationsbysubtractingcashdisbursementstosupplies,employees,andothersfromcashreceiptsfromcustomers.Theindirectmethodcalculatescashflowfromoperationsbyadjustingnetincomefornoncashrevenuesandexpenses.Mostfirmspresenttheircashflowsusingtheindirectmethod.

SCF-DirectmethodThedirectmethodissimpleandstraight:CashcollectedfromcustomersCashcollectedasinterest(利息)onloanstoothersCashcollectedasdividends(股利)oninvestmentonotherfirms’stocksCashpaidtosuppliersCashpaidtoemployeesCashpaidtootherserviceproviders:landlords,marketingagency,auditors,consultants,…CashpaidtogovernmentCashpaidtocreditorsasinterestonborrowedmoney

IndirectmethodSCFreconcilesnetincomewithcashflowfromoperationΔcash=ΔcurrentL+Δnon-currentL+ΔE-ΔcurrentA(otherthancash)-Δnon-currentAΔcash=[ΔcurrentL-ΔcurrentA(otherthancash)]+[Δnon-currentL+ΔE]–[Δnon-currentA]Op.Fin.Inv.

IndirectmethodSCFreconcilesnetincomewithcashflowfromoperationNetIncomeisaccrual-based,whenwecalculatenetincome,wedonotcarewhethercashhasbeenreceivedorpaidButcurrentassetsandcurrentliabilitiesaccountsareimpactedwhenwecalculatenetincome,e.g.,wedebitaccountreceivableandcreditrevenuewhenfinishingasalesactivity

IndirectmethodSCFreconcilesnetincomewithcashflowfromoperationSointheexampleabove,netincomeishigherthancashflowfromoperationbecausethistransactionincreasesnetincomebyincreasingrevenues,butdoesnotincreasecashbecausewedebitaccountreceivableandnocashiscollectedyet.Therefore,togettothebalanceofcashfromnetincome,wesubtracttheincreaseinaccountreceivableaccount.Thisprocedureconfirmstothecashequationinwhichincrease(positivechange)incurrentassetsotherthancashdecreasecashflowfromoperation.

IndirectmethodSCFreconcilesnetincomewithcashflowfromoperationTheindirectmethod:Netincome+depreciationIncreaseincurrentassetsaccounts+decreaseincurrentassetsaccountsdecreaseincurrentliabilitiesaccounts+increaseincurrentliabilitiesaccounts=Cashflowfromoperation

Notestofinancialstatements-oncashflows

Iscashtheking?CashistheultimatepayoffstocapitalprovidersEstablishedfinancetheorytoldusthethevalueofafirmisthepresentvalueofallitsfuturedividends

Iscashtheking?Earningsdonotalwaysgohand-in-handwithcashflows-Operationalreason:agrowingfirmcanhavefastgrowthinearnings,butduetotheexpansion,itisconsistentlyshortofcash;adecliningfirmmayhavedecliningearningsbutthrowoutlargeamountofcashduetolackofinvestingopportunities-Earningsmanagementreason:Afirmmaymanagethenon-cashearningstoincreaseearnings,butnottoincreasecashflow.

CashflowpatternfordifferentfirmsCashflowfrom:ABCDOperation$(3)$7$15$8Investing(15)(12)(8)(2)Financing185(7)(6)NetCF0000New,growingfirmGrowinglessrapidlyMature,stablefirmDecliningfirm

Iscashtheking?-Sloan[1996]AccountingReview

Iscashtheking?-Sloan[1996]AccountingReview

Iscashtheking?-Sloan[1996]AccountingReview

Iscashtheking?-Barthelal.(2001)

InvestingMottoYoucanpocketcash,butyoucannotpocketearnings!---myself'

您可能关注的文档

- 某地产项目报告2).ppt

- 塑胶模具冷却系统改善及集成水路运用试点项目报告书.doc

- 建议书(临时项目报告书).doc

- 项目报告书-齐套率改善与提升项目.ppt

- 左权县巨和新能源有限公司年产5000吨新型环保型煤加工项目报告表.pdf

- 自主学习项目报告.doc

- 股份公司组织结构及流程优化咨询项目报告.ppt

- 集团公司全面诊断咨询项目报告.ppt

- 经济园项目报告分享要点.ppt

- 国际物流公司战略咨询项目报告.ppt

- 运输公司战略管理及项目报告.ppt

- 先进电子(珠海)有限公司年产1125万片SMT贴片50万张钢网新建项目报告表.pdf

- 企业组织系统班项目报告书.ppt

- 信息技术总体规划项目报告.ppt

- 会展经济与管理专业建设项目报告.pdf

- 农业路沙口路项目报告.ppt

- 医院数字化项目报告.ppt

- 广东深圳绿景集团梅林项目报告_191p.ppt